One way to be more effective after a cheat day is to actually talk (or write) about what I learned, or at least my current understanding, from the content I took in.

The Rabbit-Holes I Find

I mentioned in a previous post that, every Wednesday, I do a what I call a “Content Cheat Day.” I essentially binge watch YouTube videos, read articles, listen to podcasts, catch up on social media, etc. It’s basically a day where I don’t create much and I go overboard on consumption.

One way to be more effective after a cheat day is to actually talk (or write) about what I learned, or at least my current understanding, from the content I took in.

So, from time-to-time, I’m going to write up a breakdown of the current rabbit-holes that have me excited or intrigued.

At the end of the day, I tend to dig into things related to systems and side-hustles. If I had to sum up what 90% of what I consume consists of, it would likely fit under one of those two categories. Even when studying philosophy, storytelling, branding, futurism, or things like mental health, I’m trying to create better understandings of what makes humans tick so that I can better create systems or to capitalize on the findings to create more income.

So, follow along to my random rabbit-holes if you’re interested in up-leveling your lifestyle through systems and side-hustles.

Settle in… These newsletters will be longer than most but, hopefully, you find a ton of value in them.

Here’s What I’m Digging Into Right Now:

- The MrBeast Approach To YouTube

- Crypto & NFTs

- Other Interesting Things On My Radar

The MrBeast Approach To YouTube

I recently watched this entire interview between MrBeast and Colin & Samir. The interview blew me away and I’m getting ready to watch a second time through to take even more notes.

Here are a handful of my takeaways:

- Focus on creating better content – Every time a question came up around growth or YouTube tactics, Jimmy kept coming back to “improve your content.” The only thing that will bring your more growth is to make better content. This was pounded into my head over and over again during the course of the interview.

- Subscribers are overrated – You don’t need a million subscribers. You just need better videos. Channels with 100 subscribers can make a killer video that gets a million views and channels with a million subscribers could get crappy views. It all depends on how good the content is. Focus on quality over “more subs.”

- MrBeast’s team and infrastructure grew slowly over time. He never went out and hired tons of people or bought up tons of buildings. They were all just added slowly over time as additional roles were needed.

- MrBeast spends 100% of his earnings on YouTube to make better videos. He reinvests it all. He doesn’t care about much materialistic stuff. His passion is making videos so he pumps all of his money back into the thing he’s most passionate about.

- MeBeast and his team can produce content at a quality level that’s equal or better to television. But he can do it cheaper and faster… And he gets more views than most tv shows, meaning brands are taking notice and spending with companies like him instead of tv. TV execs are stuck in their old ways and their old formulas are slowly losing to YouTubers.

- MrBeast would give up all revenue streams to keep his YouTube channel, even if the other streams made more money. YouTube and making videos is the only thing he really wants to be doing.

- Grab viewers in the first 10-15 seconds. All MrBeast videos give you a compelling reason, with cliffhangers, to watch the entire video. If you don’t capture attention super quick, people get bored and click away to other videos.

- Put focus on retention. Watch the metrics to see where people drop off of your videos and optimize future videos based on that info. The longer you can keep people watching your videos, the better off you’re going to be.

Those were my main takeaways. I’m sure I’ll have a lot more on a second watch. I highly recommend spending the time to listen in if you want to be doing anything on YouTube. Jimmy (AKA MrBeast) is the best in the world at YouTube at the moment.

Crypto & NFTs

A Crypto Mining Strategy I Can Wrap My Head Around

I first learned about crypto and Bitcoin around 2011, while at a conference in Austin. Coins were a few bucks each at the time and an acquaintance was trying to talk us into mining them with him because, he believed, they’d be super valuable some day… We didn’t listen.

Fast forward to today and the idea of mining crypto has popped back onto our radars. Except this time, it makes a lot of sense to me. It’s not Bitcoin, however, that I’m intrigued by. It’s a currency called “Helium.”

With Helium, there’s an underlying utility that just makes a lot of sense to me.

Here’s my understanding of how it works (but I’m at the early stages of learning so I’m open to be corrected)…

Anyone can get a little box that mines Helium. The cost of the box is roughly $500 and it costs somewhere around $5 per year to run the box. As a miner, you simply plug-in the box at home, download an app, and let the box mine Helium tokens (HNT). However, these little boxes have a utility. They serve as nodes for a wi-fi or 5g network. For every box that’s put in someone’s home, the reach and strength of these internet signals improves. It’s kind of like having little Verizon wireless antennas in individual’s homes which, when combined, create a strong network for people to tap into.

The miners earn cryptocurrency by having this box in their home, users of the network get access to this distributed wi-fi (or 5g) network, and holders or the token can see the value of their currency increase as the platform is more widely adopted.

The utility of this is potentially game-changing and could lead to the democratization of wireless internet.

Now, according to my research, someone that runs one of these miners could earn anywhere from 0.5 to 1.5 HNT per day. The current price (as of 9/22/21) of HNT is roughly $19. If we take the average and assume you’ll earn about 1 token per day, you stand to make about $19 per day, or well over $500 per month. If you purchase the miner for roughly $500, you’re in profit after your first month. Every month after that is pure passive income.

There are some potential downsides…

If you’re in an area that’s really rural, you’ll probably see less from your mining. I believe it can still be effective, it’ll just likely take you a few additional months to cross that break-even point.

The mining boxes are hard to come by. Almost all are on backorder. The box that I’m interested in, The Bobcat, says that it’ll ship in 12-20 weeks! I believe it’ll be worth the wait but I’m really impatient! I want to start earning ASAP!

One final note… There are some MLMs popping up around Helium. Don’t fall for them. If a company is offering to give you a Helium mining box for free, it’s because they want a piece of your profits. Those companies work by fronting the money for the cost of the box. They’ll pay the $500 (or whatever bulk discount price they get) and send you the box. Then, when you start mining with it, they’ll want something like 25%-50% of the income that it generates. However, if you can buy the box yourself and be in profit after 1-month, it become obvious why it’s not the best deal for you (but a brilliant model for them).

Here’s a video that I found helpful recently:

Also… Disclaimer: I don’t give financial advice. I’m a total noob with this stuff. I’m simply sharing what I’m learning to better solidify the concepts in my own mind.

My First Experience With NFTs

I recently purchased an NFT. I wanted to get in on the hype and learn what the hell was so interesting about these things. After purchasing my first NFT and getting involved in some NFT communities, I’m starting to wrap my head around things and it’s not really what I expected.

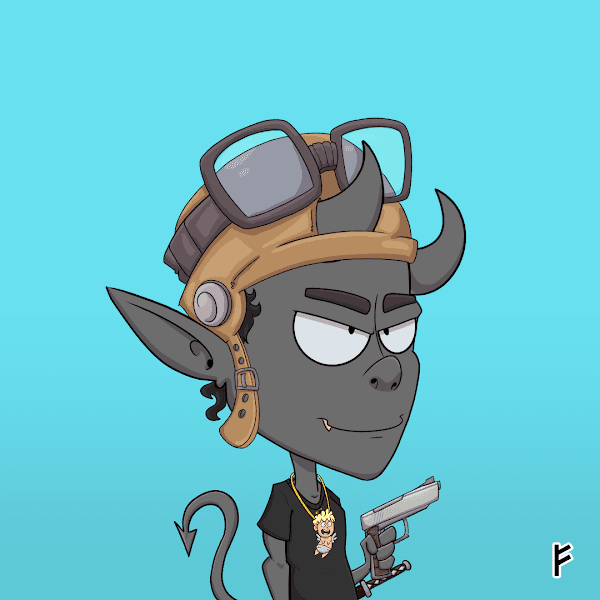

Here’s the NFT that I purchased:

I got this NFT through a process called “Minting.” Basically, instead of purchasing an existing NFT on the open market, I minted this NFT on the artist’s website. When you mint, it randomly generates a new image for you that’s completely unique to all other images that have been generated. Some attributes are more rare than others, while others are much more common. For example, the grey gun that this little dude is holding is really rare, it will appear in only 0.27% of the images that were minted. That boosts the value a little bit. The shirt, the background, and many other attributes on this image are much more common, not really helping with the value of the NFT.

This NFT is called “Sacred Devils” and it’s devil #7575. I purchased it for one reason. I heard that Jake Paul was getting behind it and was going to pump it on his social media. When a social media influencer talks about an NFT, the values inevitably go up (that was my working theory when I purchased it).

I minted this one for the cost of 0.06 ETH. At the time, that equated to roughly $300 USD.

However, what you don’t hear about much is the “gas fees.” Gas fees are essentially a variable cost of transacting with Ethereum. It’s a cost that fluctuates based on how many transactions are happening on the blockchain at a given time and the current energy costs to process those transactions.

For my purchase, the gas fees added roughly another $100 USD to the cost. Considering the gas fees, I couldn’t turn around and sell it again for the 0.06 ETH that I purchased it for because my all-in cost on it was now more like 0.08 ETH. So, in order to break-even on it, I’d need to sell it at 0.08 ETH… Right? Not so fast, there is a gas fee just to list your NFT for sale on a place like OpenSea. So, when I went to list it for sale, I’m now in for about 0.1 ETH. Now, my $300 NFT has cost me closer to $550 and, if I want any chance of a profit, I’d need to make about 0.12 ETH from it… But guess what these guys are currently selling for… The current floor price, where most are selling is actually that original 0.06 ETH.

I could sell it for what I bought it for but, after fees, I’d be taking a loss.

So, for now, I’m just sitting on it. Maybe it’ll go up in value. Most likely it won’t.

What did I learn from this?

NFTs is a game best played by people who are willing to risk a lot of money. The gas fees become much less significant if you’re playing around with much bigger numbers. Trying to buy and flip lower priced NFTs is rarely going to be profitable and, in most cases, will just lose you money.

However, I’m still VERY bullish on NFTs. Art is just the current iteration of NFTs. They’re the easiest to grasp for most people. The proof-of-ownership concept that NFTs provide do have much wider implications and will be commonplace in most industries in the future. But that’s a topic for a different day.

Here’s my current favorite YouTube channel on the topic of NFTs. This guy really makes things seem simple. Start with his popular uploads. There’s some gold in them.

What Else Is On My Radar

These are a few other things that I’ve been thinking about and studying but won’t go into as much detail on today. These are likely topics I’ll dive deeper into in future newsletters…

- Deep Integration With Brands – We recently chatted about how we’re shifting into more of a media brand focus. The big picture, which we’ll discuss much more in the future, is to lock down longterm partnerships with brands. Brands that want to partner with us for a year or more and deeply integrate with everything we do. We’re talking to several brands now, learning how these massive brand deals work, and we’ve already got some exciting things in the works. It’s a huge pivot for how we monetize but a very minimal change in how we operate day-to-day. Keep an eye and ear out for more discussions around deep-integration brand deals.

- Understanding The World of Real Estate – During Traffic & Conversion Summit, we met with a guy named Roy. Roy is purchasing real estate in popular tourist destinations and then renting them out as AirBnB’s. His monthly profit margins on these properties are often 8x-10x what his monthly mortgage is on some of these properties. I also really enjoyed this Twitter thread from Taylor Welch about how his company is generating $300k per month from their real estate deals. I own my own house but, other than that, I’m an R/E noob. I’m excited to explore this rabbit-hole deeper.

- YouTube Advertising – We recently started running YouTube ads to test if we can grow a YouTube channel using YouTube’s ad platform. Early tests have shown that we can quickly up our view counts with ads but, getting them to subscribe has proven to be a bit more difficult. That being said, we partnered with Tom Breeze, who says he has a method to grow a YouTube channel with ads. We’ll see how it all goes and I’ll report back.

- Notion For Managing Personal Finances – I’ve started playing around with the productivity tool, Notion, recently and have really been enjoying it for some specific tasks. Namely, I really like using it as a database to track bill payments as well as a database to track side-hustle income. Tables and databases can cross-link between each other and you can really pack a lot of data in there in a way that’s easy to consume. My favorite YouTube channel around the topic of Notion is called Red Gregory. I’ve been binge-watching their videos because they are really detailed and can really get into the technical stuff in a way that’s easy to follow.

- Systems & Side-Hustles – Finally, I’m thinking I’d like to start posting videos on my personal YouTube channel again. I’ve struggled with making the next move there because I didn’t feel “niched down” enough. We’ve got Hustle & Flowchart, which talks business, lifestyle, and marketing but that’s mostly interview content. I love making screen-sharing / tutorial content. So I’ve decided my niche on YouTube for my personal channel will be “systems and side-hustle.” I know I can make tutorials and lessons around those two-topics. I’ll cover systems to free up time and to do more of what you love and I’ll cover side-hustles to generate additional streams of income, also improving lifestyle.

That’s all I’ve got for right now (and it’s much more than I anticipated writing). I’d love to hear from you on these topics! If you’ve got some great resources around systems or side-hustles, shoot them my way. I’m excited to keep digging and to continue sharing what I’m learning along the way.